Clash of the Metaverse Titans: Microsoft, Meta and Apple

The three incumbents with the most staked on the metaverse are Meta (Facebook), Apple and Microsoft.

The three incumbents with the most staked on the metaverse are Meta (Facebook), Apple and Microsoft.

This article was originally written in November, 2021. An amazing amount has happened since then; I’ve updated to include the acquisition of Activision-Blizzard by Microsoft.

In this article, I will explain why that’s the case, using the methodology I began in the Value-Chain of the Metaverse. I’ll cover the metaverse technologies they are investing in, along with their differences in business model and network effects, and how this may give us some insight into the future.

Apple

Apple is the most vertically integrated computer technology company ever created.

Apple has massive advantages when it comes to creating a version of the metaverse:

Experiences: Apple original TV programming is Apple’s largest foray into actual content experiences. It’s hard to say whether Apple will continue to fund more experiences, but this TV programming shows that they’re no longer opposed to becoming content creators.

Discovery: App Store, Apple Music, Apple TV and Apple Search Ads

Creator Economy: Xcode, needed for building MacOS and iOS applications of any kind, and numerous developer frameworks.

Spatial Computing: Metal (Apple’s 3D graphics API), Apple Maps (which is mapping the Earth, a critical resource for augmented reality applications) and — most importantly — ARKit, the development framework for Augmented Reality applications, which is enabling Apple to create a significant developer ecosystem in advance of more advanced AR/VR hardware.

Decentralization: not particularly decentralized — indeed, Apple seems fairly hostile to the whole idea of decentralization. Their business is built around vertical integration, not sharing their technology stack with others. Apple’s trajectory appears well on the way to becoming even more centralized. Recent changes to Apple’s advertising ecosystem (clothed in admirable “privacy” features) does not apply to Apple’s own advertising network, which has resulted in a significant boost in market share for Apple Search Ads. Other privacy features such as Private Relay, offers Safari web browsers greater protection of their IP addresses — but passes data through Apple’s centralized service, which opens the door to Apple becoming a permissioned gateway to the World Wide Web. When Apple talks about interoperability, they’re usually referring to interoperability between Apple products — not between the internet and other vendors. Apple is looking into blockchain, but there’s no word whether this is just exploratory or the foundation of a serious plan.

Human Interface: Apple makes computers, the iPhone; wearables like the Apple Watch; the Apple TV. Tim Cook has described augmented reality as “one of these very few profound technologies that we will look back on one day and, ‘How did we lives out without it?’” Augmented Reality has the potential replace virtually all of our other screens through digital holograms. There are few companies that can manufacture hardware at the scale of Apple, so when they finally have a consumer-ready augmented reality headset it will likely become one of the principal ways we access the metaverse.

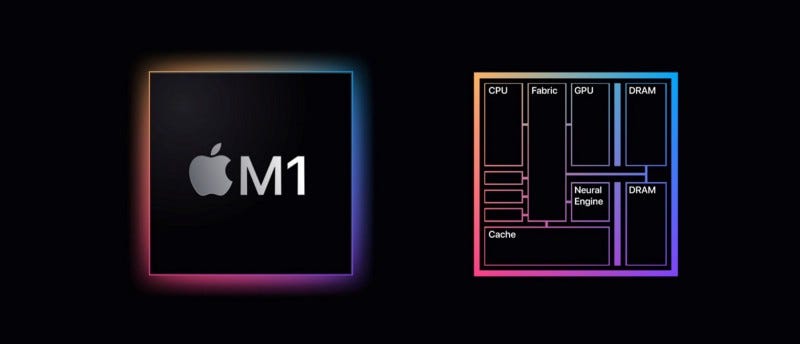

Infrastructure: With the M1 chip, Apple is now a major semiconductor company. The M1 is a reflection of Apple’s vertical integration — in this case, providing a complete “system on a chip” that unifies memory, GPU, CPU and Artificial Intelligence processing in a way that improves performance and power utilization, all of which will be key to enabling consumer-ready augmented reality. Of the three companies, Apple is far more advanced in its fundamental science and semiconductor engineering.

Apple is ultimately a hardware business with a rapidly-growing and thriving services business built on top of it. Apple genuinely wants to bring consumers amazing experiences — but the cost is a lot of permission, control and tollbooths along the way. As long as Apple has existed, they’ve sought to vertically integrate as much as they can — while adding more centralized control of their technology as they do so — and one can expect this to only continue.

Microsoft

Microsoft is the most decentralized of the three titans: PC software development remains one of the truly “open” and permissionless software ecosystems — one that Microsoft profits from handsomely through the Windows operating system, while also enabling software developers to extract most of the value.

Satya Nadella presented his vision of the Metaverse at Microsoft Ignite. Here’s where Microsoft stands now:

Experiences: Microsoft has done the most of our 3 titans to advance and develop experiences: through homegrown products like Microsoft Flight Simulator — and through acquisitions, a roster of premier game studios that have produced hit franchises like Halo, Fallout and the Elder Scrolls. With the Minecraft is a household name; and the creativity of Minecraft shows much of what the metaverse’s creator economy could look like. Microsoft Teams is a chat and conferencing platform that may lead the way to more immersive and embodied workforce collaboration in the future. With the addition of Activision-Blizzard, they gain several other proto-metaverses (Diablo, World of Warcraft, Hearthstone), premier AAA games (Call of Duty) and one of the top mobile franchises in the world (Candy Crush). Microsoft is now arguably the largest, more expansive and diversified multiplayer gaming company in the world.

Discovery: Microsoft has brought software distribution closer to the operating system thanks to the Windows Store, while still enabling software developers to distribute however they like. The Xbox game console has a closed distribution ecosystem. And of course, Microsoft owns ad networks and the second-largest web-page search engine.

With the acquisition of Activision, they’ve gained Battle.net — a real-time presence and communication system for games. It would make sense to build a bridge between this, the Xbox, and other Microsoft-owned communication systems to create the ultimate gamer discovery channel to rival the Epic Game Store and Steam.

Creator Economy: an extensive set of developer tools including Visual Studio and countless other tools. And Minecraft is training countless kids on how to create content in a relatively open metaverse. Microsoft has also been investing in artificial intelligence technology — especially natural language processing — which will be important for no-code/low-code creative tools and virtual beings.

Spatial Computing: DirectX is the 3D graphics API that nearly all PC software ultimately depends on, and Microsoft is investing in the operating system technology that will enable augmented reality to function in a seamless way with our physical environment. The AI and deep learning technology Microsoft is investing in has applicability to image recognition which will be critical for augmented reality.

Decentralization: as noted above, PC software development is essentially permissionless. Microsoft is also investing in technologies like self-sovereign identity that could provide an open and decentralized means of authenticating and owning your identity without the centralized control of platforms like Facebook Login.

Human Interface: the Xbox game system has given Microsoft many years of experience working with GameTech and making it work with hardware. Microsoft is building up massive manufacturing scale on Hololens, their augmented reality product, thanks to a $21B deal with the US Military. Although Hololens is targeted at government, military and business customers — this may give Microsoft a head-start that allows them to perfect it before bringing it to consumers at even greater production scale.

Infrastructure: on the semiconductor front, Microsoft simply isn’t at the same level as Apple — yet if open positions at Microsoft are any indication, they intend to change that. They’re currently recruiting for engineers to help with display engineering as well as artificial intelligence silicon. On the other hand, the Azure cloud infrastructure business is enormous and an enabler of applications, games and metaverse experiences.

Microsoft is the yin to Apple’s yang; where Apple is a hardware company with a substantial service business — Microsoft is a software and services company with a growing hardware business. This is reflected in Microsoft’s business model, which is geared towards getting the most developers to adopt its software ecosystem.

Bill Gates claimed, “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it.” Microsoft seems more interested in selling the software and services to make developers successful, and less interested in extracting rents and control (although exceptions like the Xbox do exist).

The core technology and infrastructure resources of Microsoft were cited as some of the major reasons with Activision-Blizzard merged with them. Bobby Kotick cited “disciplines like AI and machine learning, or in data analytics, or in purpose-built cloud and cybersecurity — and that we just don’t have. And that competition for that talent is expensive, and really hard to come by.” This speaks to why companies who are democratizing, simplifying and commoditizing the cloud-services layer of the metaverse will be key to expanding the number of market participants.

Meta (Facebook)

I originally wrote-up Facebook’s metaverse investments a bit before their Meta re-branding announcement. You can read the original here. The following breakdown has been updated to include some of Meta’s recent acquisitions, the comparison to our other titans, as well as indications of how Meta is now investing in materials science and semiconductors:

Experiences: Meta acquired Within, the creators of Supernatural VR, an immersive fitness platform that takes place in virtual reality (with landscapes as far-off as the surface as Mars!) along with regular content updates and competitive dynamics. Facebook and Instagram have been increasingly adding real-time experiences such as livestreaming. And Venues is a way to watch movies or hang out with your friends in an immersive social experience. The Facebook Connect 2021 keynote covered how Facebook sees the metaverse evolving within their ecosystem — with a focus towards “embodied” experiences within virtual and augmented reality.

Discovery: Meta is an advertising company, which makes them quite a bit different from the hardware business of Apple or the software/services business of Microsoft. This is reflected in almost everything they do; advertising must be integrated into products to drive the revenue that will support the $10 billion (and more) per year that Meta expects to invest in the metaverse. Their other sources of revenue include revenue share that comes from the Oculus store, which is another form of discovery.

Creator Economy: Horizon Worlds is Meta’s developer platform for creating virtual reality content. It includes no-code/low-code tools to content creation. Meta also announced that they expect to make it possible to create accessories for your avatar that would interoperate with applications that are not owned by Meta, utilizing NFTs.

Spatial Computing: along with their hardware products, Meta is investing in software to create the multi-layer user interfaces, digital holograms, AI for gesture recognition, etc.

Decentralization: we don’t really know what Meta’s plans with respect to decentralization are. They’ve had some half-hearted initiatives around digital wallets (Novi) and their own experiments in digital currency (Diem, formerly known as Libra). They mentioned NFTs as a means of providing interoperability for digital assets, but it is important to note that NFTs can easily be created on a private, centralized blockchain as on a permissionless, decentralized blockchain. But will you be able to create immersive content in something like Horizon that could be deployed anywhere using open standards like OpenXR? Nobody knows yet — although it’s hard to see how that would fit Meta’s business model.

Human Interface: hardware includes the Oculus virtual reality platform, as well as the Ray-Ban Stories smart glasses. While the latter do not yet include augmented reality features, they do have a camera, voice recognition commands, and a high-quality audio feature that I find more pleasant than wearing earbuds — and this ergonomic form-factor gives us a window into what headsets will evolve into. They also spent over half a billion dollars acquiring neural interface company CTRL-Labs.

Infrastructure: this is an area where Meta is playing catch-up to both Microsoft and Apple, which both have years of advanced hardware and manufacturing experience. The Oculus is largely built from components and semiconductors from other suppliers, but the hiring plans at Meta show that they intend to invest heavily in materials science and semiconductor engineering, following in the footsteps of the vertical integration Apple now enjoys. Job postings refer to positions to develop new integrated circuits, OLED circuit design; advanced materials engineers (“new materials for consumer near-to-eye displays”) and photonic devices (“LED and laser devices core to delivering transformative experiences in Oculus AR/VR products”).

Network Effects and Business Model Distinctions

Aside from the various investments being made in hardware, augmented reality headsets, experiences and the creator tools to make them — the most profound differences between Microsoft, Meta and Apple is their business models.

At their core:

Apple is a hardware company.

Microsoft is a software, services and content company.

Meta/Facebook is an advertising company.

I believe the way each company approaches new products, pricing, rents, privacy, permission and gatekeeping will reflect this DNA.

In Tech’s Two Philosophies, Ben Thompson laid out the distinction between a platform that creates the most opportunity for its developers — versus an aggregator of demand that captures most of the economics for itself.

Apple looks like this today:

Facebook looks much the same — most revenue is captured in the form of discovery (via advertising or the Oculus store).

Microsoft’s network effects and revenue come from the health of its developer ecosystem more than the ability to capture and control distribution.

Honorable Mention: Alphabet and NVIDIA

A couple other titans are worth noting, but didn’t quite make the cut for this article.

NVIDIA’s semiconductors lead in virtually all the areas that are critical to the growth of the metaverse: graphics processing units (GPUs), artificial intelligence and datacenter operations. And they’re also working on the Omniverse platform, which is focused on workforce collaboration between various artists, engineers and designers within immersive space.

Alphabet’s discovery services are the most important on the internet — between the Google search engine, YouTube, and the Google Play store. They’ve dipped their toe into the experience layer with Stadia. Their approach to hardware has been to license its operating system to the world (Android). And they have a growing cloud service business. Of all the companies mentioned, they have probably invested the most in artificial intelligence research. Yet they simply don’t have as coherent a strategy for the metaverse in the same way that Apple, Microsoft and Meta appear to. That said, one can imagine them fixing this quickly.

Further Reading

Read this thread on Twitter that discusses some of the strategic reasons for Microsoft’s acquisition of Activision, and what it means for the rest of the game industry (and metaverse).

Read The Metaverse Value Chain to gain an understanding of the 7 layers I’ve covered here — experience, discovery, creator economy, spatial computing, decentralization, human interface and infrastructure.

Check out my Market Map of the Metaverse to learn how 200+ companies fit into the 7 layers.

Read Experiences of the Metaverse to gain some inspiration about the types of things we’ll be doing in the metaverse.

Podcasts and Videos

If you’d rather watch videos, you can begin your journey here:

Or, if you’d prefer an audio-only format, the same Building the Metaverse content is available in podcast form at Anchor.fm. You can hear the latest episode here: