Game Economics, Part 2: Digital Collectibles and NFTs

A new class of digital collectibles enabled by Non-Fungible Token (NFT) technology has opened up an exciting new opportunity for game…

A new class of digital collectibles enabled by Non-Fungible Token (NFT) technology has opened up an exciting new opportunity for game developers and game hobbyists alike.

In speaking with hundreds of game developers and crypto fans about NFTs, I’ve discovered that there are many misunderstandings between these groups. They use two different languages: crypto fans often talk about revolutionary technology and societal change, and game developers usually just want to create fun. This article will seek to bridge that divide. If you’re in either of these communities, invest in them, or are simply curious, you’ll learn how everyone can work together to bring innovation and entertainment to the world.

In Part 1 of this series, I covered the past and present of game economics, from the evolution of the industry from arcade machines and into a present that delivers more than half of its revenue through live game services. In Part 3, I do a deep dive on free-to-play economics.

A few of the things you’ll learn here: how it all began with collecting games, the technology that transports these experiences to digital, the emotional qualities that distinguish ownership from existing virtual goods, the ecological impact, and some of the transformative opportunities that exist in the future.

What Is an NFT?

An NFT is simply a digital collectible on a blockchain. A blockchain is a distributed ledger that uses cryptography to enable transactions to be performed without a central authority.

We use the term NFT (which stands for “non-fungible token”) to distinguish it from cryptocurrencies such as Bitcoin or Ethereum, which can be subdivided into tiny units. With a particular cryptocurrency, you don’t care whether you have one coin or another; they are equivalent to each other (similar to how you’re willing to share one dollar bill for any other dollar bill). That’s fungibility. A “non-fungible” asset is one that isn’t divisible and where you do care which one is which: a painting, a house, a car — or a digital collectible.

NFTs have different features than a typical collectible that might exist inside an established game economy. Some of the most important features include:

True Ownership. Unlike a virtual asset or currency that can be taken away from someone at the whim of a central authority (such as the game’s owner), NFTs are actual assets that are owned in a player’s wallet.

Permanence. Once an NFT is minted, it may exist on the blockchain forever.

Provable Scarcity. Because all of the records are publicly accessible, software can inspect the blockchain and confirm how many can exist. For example, if an item is one of a kind (often called a “1 of 1” in the NFT space), you can confirm that. If it is from a limited edition of 1,000, you’d be able to confirm that as well. There’s nobody you need to trust.

Provable Provenance. The history of an item’s ownership is recorded in the blockchain. Some items may gain value simply because of who has held it in the past. With an NFT, you’ll know exactly who has held it (all the way back to the creator).

Programmability. Using a technology called “smart contracts,” NFTs can take on special behaviors or be traded between players — or even other games and worlds.

Decentralization. There’s no central authority that controls the economy and enforces smart contracts. The economy maintains its integrity in a completely trustless way, and now the community has the ability to add enormous value to the ecosystem.

Most of the heat generated around NFTs so far has come from the digital art world; creators see it as a way to build communities directly with their collectors, outside of the traditional gallery and market ecosystem that takes 80–90% of their potential revenue. Collectors see it as a way to collect works that have proven scarcity (similar to a limited-edition print) while more directly supporting their favorite artists. Others have noticed opportunities in music and fashion — as well as other assets such as domain names or real estate. Naturally, people are also asking: can NFTs apply to games, which have been minting virtual goods without the blockchain for years?

Objections from Game Developers

The features of NFTs can result in entirely different types of game experiences. But before we can get to those opportunities, it is helpful to understand the objections I usually hear from game developers:

“Players can already collect virtual items in our games.” Of course they can. But this is always performed within a centralized infrastructure. There are a number of opportunities, features, stories, and even emotions that are virtually impossible to enable within a centralized infrastructure. Most of this article will attempt to excite you with what those opportunities are.

“Blockchain technology is a terrible back end for our systems.” Yes, blockchain technology is an extremely inefficient back end to replace the existing datastores used in games with virtual goods and virtual currencies. Conversations that focus on this topic miss the point of the transformative gameplay that this technology enables.

“Opening up my game economy to player-to-player exchanges would destroy my economy and fun.” That’s probably correct in most cases. The game designer is simultaneously the monopoly supplier, the central banker, the currency exchange, the auction house, and the trade regulator. In games designed like this, it is a feature of the game that the supply, demand, and exchanges are tightly controlled. Again, conversations that focus on the risks of adding decentralized control to an existing centralized economy tend to miss the point: that there are certain features that could be added to existing games, as well as entirely new types of games that can be built from the ground up using decentralization.

“This will never work in an existing game.” If you’re thinking about strapping decentralization onto an existing game, then you’re right for the reasons described above. But there are a number of interesting opportunities that any game could start to consider, and I’ll write about those below.

“I can’t allow players to take items from outside my game into my game.” Nothing about using NFTs or blockchain requires you to do this. You can completely control the gates in terms of what you let in and out of your game experience.

“I can’t rebalance the game if I need to.” That’s not accurate. Similar to how Wizards of the Coast eventually banned the Black Lotus from normal play, you can determine the rules that govern how people use an instance of an item they own. The primary function of a token is ownership, not rules. Even if some sort of metadata is inscribed on the token, nothing prevents you from overriding that in a given game where balance is required.

“Blockchain technology is very slow, expensive, and inefficient and has a terrible ecological footprint.” This statement may be somewhat true as a generalization, but wrong with respect to the blockchains that most games will use. I’ll address below the technology options for blockchain that do not suffer any of these problems.

“Existing user experience around NFTs is terrible.” This is absolutely correct, but this is frequently what happens in any new market. There are currently confusing hurdles, poor user interfaces, and awkward steps involving multiple exchanges and points of sale. Few understand how to navigate the environment, and the entire cryptosphere is full of its own language and shibboleths. Although this is relevant to launching a game right now, it is likely to improve rapidly.

Misunderstandings from Crypto Fans

“Players want this feature in your game.” Players want lots of features, and not all of them add to a fun experience. Soren Johnson has a famous quote about players optimizing the fun out of a game if given the opportunity. Game designers are in the business of fun, not simply adding a feature.

“We want to be able to take items from one game into yours.” See above. For the most part, controlled economies are a feature of games, not a bug. There might be games that allow this in the future, but they’ll likely be designed from the ground up for this concept.

“You won’t be able to stop this change.” There’s a euphoric optimism that pervades the Discord servers and Clubhouse channels of the cryptosphere; I happen to think it’s true that these technologies won’t be stopped. However, they won’t replace all the virtual economies that exist. As noted above, centralization is a great feature of many games. The opportunity is to create new types of games, not replace the existing ones. This technology is likely to be more of an expander than a disruptor.

Opportunities for Game Developers

Magic: The Gathering (MTG) is a tabletop collectible card game that was launched before Internet-based gaming became popular. As of this writing, the highest price paid for an MTG card is $511,000. This card is so valuable because it is extremely powerful and extremely rare (it never made it out of the beta version of the game).

MTG is a “duelling” game, meaning the basic rules are that players play against each other. However, it didn’t take long before the community of players started inventing new modes of play. For example, players invented various multiplayer formats such as Two-Headed Giant and Round-Robin play. Sometimes they created their own house rules. These are examples of the community taking ownership of the game system itself; it is the consequence and opportunity of decentralization.

I see a future where there’s a new type of game company that is a “digital collectible first” game studio. In this future, a game company mints the first collectibles and supplies the first game client; they might even open-source the game client and allow people to create their own version of the rules and the experience. These developers will be less focused on software and more focused on creating collectibles people want to own. This is just one example of decentralization, and seeing the world through this decentralized lens leads you to think about entirely new ways of creating fun experiences for players.

And how many virtual items, within a centralized economy, have sold for $511,000? There’s something to be said for the idea of owning something and knowing that it will last beyond any one game’s life cycle. In a decentralized, permanent economy of collectibles, a player could display their favorite items in a collection in places like cryptovoxels, even if they never play again.

What are some of these use cases?

Preserving Your Experiences. An opportunity that applies to both existing and new games is that they could help record your experiences. Imagine being given a trophy for exploring an interesting place, winning a game, reaching a certain level. Long after you’ve put down that game, that memory could be inscribed in a virtual artifact that becomes part of your permanent collection. In a story-driven economy, these sorts of memories are more important than ever.

Increased Value Perception. Players suspend their disbelief in games and pretend to own virtual items; this fuels a $100B+ industry. But they’ll value these items even more if they actually believe they own them. Imagine how much this sense of ownership might change the way you could approach game worlds.

New Forms of Funding. Games currently are funded by equity investors, publisher financing, or by crowdfunding (presales). Selling limited-edition items could be a new way of funding a game’s development even earlier in their life cycle than crowdfunding. And unlike crowdfunding, this also offers advantages of trading and liquidity. Players who own assets are likely to become even more “invested” in the game’s success, and if you treat them well they may become huge promoters. Indeed, one of the biggest costs of game development right now is the high cost of customer acquisition; but what if you could shift those costs away from an operating expense and into a (slight) dilution of your assets by airdropping collectibles to your evangelical fans?

New Opportunities for eSports and Streamers. Since provenance is provable with NFTs, one of the ways an item will accrue value will include not only what the item is, but who has held it. A costume worn by a top-performing eSports star during a tournament victory would always carry that story with it — and potentially become an additional revenue model for the eSports industry and the game publishers alike. Streamers who demo a game, cover an event, or help with a launch could be rewarded with items that would be extra-valuable to their own communities: they could pass them on to their fans or resell them as a source of income. Indeed, this appears to be a big part of the vision for Theta, which is building a decentralized streaming network on their own blockchain.

Games Built from the Ground up for Trading. Magic: The Gathering has an open economy; they’ve proven that this can add substantial value to the collectibles. Focusing on the value creation of their assets rather than selling software frees game companies to build entirely new experiences that players can enjoy. And unlike trading cards in the real world, the developer could utilize smart contracts on NFTs to pick up a share of the trade each time it is resold.

Games Built from the Ground up for Communities. As players own the assets of the world, what might it mean to allow players to add software as part of the decentralized ecosystem? We’ve seen a microcosm of this within the world of modding games and the user-interface scripting happening in MMORPGs. Decentralization could radically open up the game world to new experiences.

Play-to-Earn. In Part 1 of this series, I wrote about play-to-earn in the context of eSports. But this potentially creates new ways for players to earn: they could do the hard work of uncovering resources and items that are scarce and desirable, and sell those to other players. MMORPGs with controlled economies have viewed this as more of an exploit (and regularly ban players for secondary-market trades), but this could be a compelling aspect of a new class of games — and, using the smart contracts referred to above, they need not be left out of the ongoing revenue it generates.

Limiting the Number of Players. What if a game were created in which even being able to participate were limited? The music industry has shown as similar stories: Wu-Tang Clan published one copy of their Once Upon a Time in Shaolin (acquired by infamous “Pharma bro” and convicted felon Martin Shkreli). 3LAU just sold 33 specially minted copies of Ultraviolet, earning over $11M. One can imagine a game that not only has unique items at this level of rarity but, perhaps, a limit on the number of people who can play the game at all. Some games might benefit from smaller populations of players rather than racing to fill worlds with as many people as possible.

Portable Assets in the Metaverse. Yes, this is a thorny issue, and I don’t think we’ll see you walking into League of Legends with an item you found in World of Warcraft anytime soon (if ever). But there are virtual spaces that function more like social gatherings than games — and I think lots of people would enjoy displaying their trophies, costumes, and artifacts from a variety of games within these locations. Remember that the metaverse will be more like a multiverse than a monolithic virtual reality. And there’s a rich space here waiting to be mined by virtual fashion designers, jewelers, and tattoo artists.

The above are just a few of the ideas that come to mind when thinking about provable provenance, provable scarcity, permanent ownership, decentralization, and programmability. If you start thinking more along these lines and less about simply backing these features into existing games, I think you’ll start getting just as excited as I am.

Technology Options

Let’s cover the main technology options you have available as a game developer.

First, it is important to realize that most of this is new. Game developers who start building now will frequently build more plumbing than people will need to work on later — but much of this will change rapidly across the span of 2021.

The first technology to understand is the blockchains themselves. You can build a game on top of three main categories of blockchains:

1) Ethereum-Based Blockchains. This is where most existing NFTs, primarily in the digital art space, have been created. Examples include Nifty Gateway, Mintable, makersplace, SuperRare and Rarible.

On Ethereum, it is possible to derive new currencies from the underlying ETH coins; these are called ERC20 tokens. Enjin is an example of a blockchain based on ERC20 which has been purpose-built for the game industry. Similarly, NFTs on the Ethereum network have a standard called ERC721 that makes them interoperable within various applications.

Here’s the main problem with Ethereum: it is what’s called a Proof of Work (PoW) blockchain, which means that transactions and smart contracts are executed on a network of computers that do a substantial amount of cryptographic work to validate whatever happens. This process is slow and expensive (and many people are also concerned with the ecological impact, which I discuss below). Since most games need to do a lot of microtransactions, and do them quickly and inexpensively, PoW simply isn’t an option for the vast majority of games.

There’s a new kind of validation technology called Proof of Stake (PoS). Without getting into the details of this technology, PoS results in a profound decrease in the amount of computation that needs to happen on the network. Ethereum 2.0 will be based on a PoS algorithm, but there’s no telling when it will be available. At the time of this writing, the most optimistic forecasts expect it to come by the end of 2021; others think it may take years.

In the meantime, the other option is to use a Layer-2 network. These networks typically use PoS on a network that’s to the side of the main Ethereum network, and they add an additional gate in and out. Think of the Layer-2 network as a separate theme park with lots of independent rides: within, all the transactions are fast and cheap, but if you want to take anything with you, there will be fees for exporting or importing to the outside world. If you’re committed to building on top of Ethereum (which does have distinct advantages, not the least of which is that there are people with tons of Ethereum wealth who need things to spend it on), then you’ll want to investigate this. Enjin’s layer-2 network, called Efinity, is in early access. Immutable which powers Gods Unchained, is another emerging layer-2 solution built on Ethereum that promises to handle microtransactions at high volumes at low cost. Other layer-2 networks include Optimism, Arbitrum, and Polygon.

2) Purpose-Built Blockchains

Some of the most popular collectible “trading card packs” and games have been built on top of Proof of Stake blockchains that themselves were built from the ground up for the microtransactions and high speeds required by games. The best examples of these include Worldwide Asset eXchange (WAX), which is home to the Street Fighter trading cards, and Flow, which is from the creators of CryptoKitties and used to power NBA Top Shot.

The unknown with Flow, Immutable and WAX is how well they’ll scale over the long term. However, they benefit from being exposed to games and decentralized applications that need to transact quickly and inexpensively.

3) Ethereum Killers

Ethereum has suffered from the “scalability trilemma” for quite some time — the problem being that it is extremely hard to deliver a network that is decentralized, scalable, and secure. Scalability suggests high concurrency, low costs, and high speed. If you’ve ever used an Ethereum decentralized application, you’ve probably been shocked by how expensive the “gas fees” are (the amount you pay the nodes on the network to process your transaction) and how slow it is. This has given rise to a number of “Ethereum killers” built on Proof of Stake: Avalanche, Polkadot, Algorand and Cardano are the largest; and Theta’s decentralized video streaming network also has an NFT implementation for emotes and badges. All of them will support their own native NFTs; however, most of these applications aren’t quite ready yet, and when they are there’s likely to be a bunch of plumbing you’ll need to build. Despite this, the competition in this area gives one some faith that there will soon be quite a few new options.

Which Blockchain Should You Build On?

If you need to release a game soon, then your best options are to look at the purpose-built networks like WAX, Immutable, Flow, and Enjin. If you have time to wait, it may be worth waiting to see how Ethereum 2.0 vs. the Ethereum killers plays out during 2021. The one option you can’t seriously consider is Ethereum in its current form. Your game will almost certainly need to do microtransactions — a digital art collector might be willing to pay a $100 gas fee to buy a $1,000 piece of art, but they won’t pay $100 to pick up an NFT that might only be worth pennies.

Tooling

You’ll also need more than a blockchain — you’ll need the technology to manage your virtual inventory and economy as well as the user interface that makes it player-ready. Otherwise, you’ll be using a huge amount of your capital to build those yourself.

My own company, Beamable, is working on the technology to help you manage your tokenized virtual item inventory and manage your game economy. Crucible is working on a user agent that can provide frictionless access to the decentralized NFT ecosystem at the UI level. Tooling is still at an extremely early stage, but you can expect it to improve considerably in the near future.

Ecological Impact

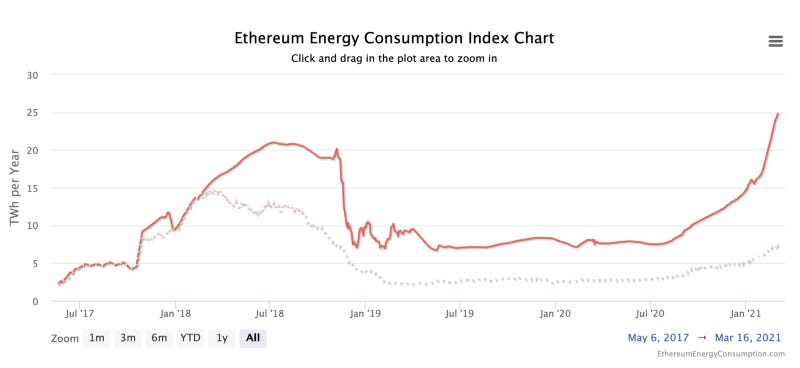

In February 2021, the Ethereum network consumed 24 terawatts of energy, which accounted for about 0.1 percent of all energy in the world. It sounds like a small amount until you realize that it is about as much as the entire country of Ireland used in that same month. Many people are worried about the ecological impact of using that much energy to support NFTs.

No game should be on the main Ethereum network. Even if you aren’t concerned about energy usage, then the gas fees and slow speeds of Ethereum are going to be harmful to your game. If you focus on a PoS network (whether purpose-built like Flow, a layer-2 network like Efinity, or a coming-soon solution like Avalanche), you can sleep easy knowing that your customers will enjoy fast, cheap transactions with minimal energy expenditure.

It’s fair to say that energy usage for other non-game applications of NFTs is problematic. At the level of marginal energy utilization, there’s simply no comparison. Decentralized transactions, in their current implementation within PoW blockchains, cost exponentially more than centralization. Since NFTs for digital art mostly use Ethereum, these transactions do consume a great deal of energy. However, I have participated in this economy because I do not believe that simply comparing transactions between centralized and decentralized systems captures the totality of costs. A centralized financial infrastructure consists of skyscrapers full of financial companies, private jet–fueled roadshows, armies of middlemen, and vaults full of gold that cost enormous energy and shift too much of the economic benefits from investors to rent-takers. Similarly, traditional art markets consist of galleries, shipping companies, and fancy storefronts that leave only 10–20 percent of sale prices to the creators.

When PoS rolls out more broadly in a year or two, the high energy costs of the digital art markets will be substantially lower — likely a reduction of 99% or more. If you don’t feel the shift to decentralization makes up for it in the meantime, you can do as I am doing and donate to organizations that reduce or capture carbon emissions. Or you can simply choose not to participate until all of the problems are solved. Either way, if you’re building a game, you ought to build on top of PoS from the beginning and rest easy.

The Future of the Metaverse is Decentralization

Decentralization will change radical elements of our economy in the years to come: decentralization of technology, of financial markets, and of applications. And it promises to infuse new forms of fun and experience into games as well.

If you enjoyed this explanation of NFTs for games, you may also enjoy Part 1 of this series on the economics of games, which covered the history and the present of the game industry. Part 3 takes you on dive deep into free-to-play — now the largest and most important part of the game industry, and one that is likely to grow alongside newer models such as digital collectibles.

Additional Resources

Following the many hyperlinks throughout this article will provide many hours of exploration. If you want to continue down the rabbit hole, here are a few more resources I recommend:

NFTs and a Thousand True Fans: a write-up by Chris Dixon from a16z on how NFTs will shift the economy towards creators and fans, and away from rent-takers.

A DeFi Stream of Consciousness and the Opportunity for “Trustless Games”: Richard Kim’s (of Galaxy Interactive) journey into decentralized finance (DeFi) and how game-like it feels. As you explore the world of NFTs, learning more about DeFi will open your eyes to what’s happening across the rest of the ecosystem.

The Problem with CryptoArt: for those of you concerned about the ecological impact of running the Ethereum network that is powering NFT transactions, this is a well-rounded critique of the issue. It doesn’t attempt to explore the totality of costs in decentralization vs. centralized economies (as noted above), and it may underestimate the level of effort to transition an existing application like Nifty Gateway to PoS, but overall, it brings forth solutions. As I noted earlier, any game should only be considering PoS for pragmatic business reasons — in addition to the ecological concerns.

A Primer on NFTs and Intellectual Property: legal questions about ownership and licensing often come up in discussions of NFTs. A lawyer answers many of these questions here (and raises some new ones).