Network Effects in the Metaverse

As I noted in my previous post about the experiences of the metaverse, the content and applications of the metaverse are already incredibly…

As I noted in my previous post about the experiences of the metaverse, the content and applications of the metaverse are already incredibly diverse.

The metaverse is already here. But when we speak about it, we’re talking about what it is becoming.

The forces that are driving this evolution of the internet are an orientation towards activities, an exponential rise in creators, and a decentralized ecosystem that allows linking, embedding and mashups of content.

But how will creativity, innovation and wealth be distributed amongst the metaverse markets? That’s what I’ll consider in this article.

I distinguish two emerging models for the platforms which will enable the metaverse: one which looks more like Amazon, and another which is shaped more like Microsoft.

Emergent versus Constrained Networks

Wealth distribution has much to do with the topology of the metaverse: how is it organized around networks, endpoints, and users? How will distribution be controlled? How will demand be aggregated?

Let’s consider two extremes of how networks form.

Hub and Spoke

The first is a “hub and spoke” model where every network node connects to a central authority that is responsible for controlling access and managing any of the exchanges; if you want to transact with another node on the network, it will be through that central authority rather than between each other directly.

Scale-Free Networks

The second is a scale-free network where the central node acts more like a facilitator than an authority, and where nodes are then free to connect with each other.

Now, true scale-free networks are rare; and perfectly constrained hub-and-spoke networks don’t tell the complete story either (these nodes may be free to connect with each other on their own, albeit not with respect to the specific exchanges governed by the central authority).

However, the degree with which the central node controls, versus facilitates, is the conceptual framework that you can use to understand how certain kinds of networks are structured.

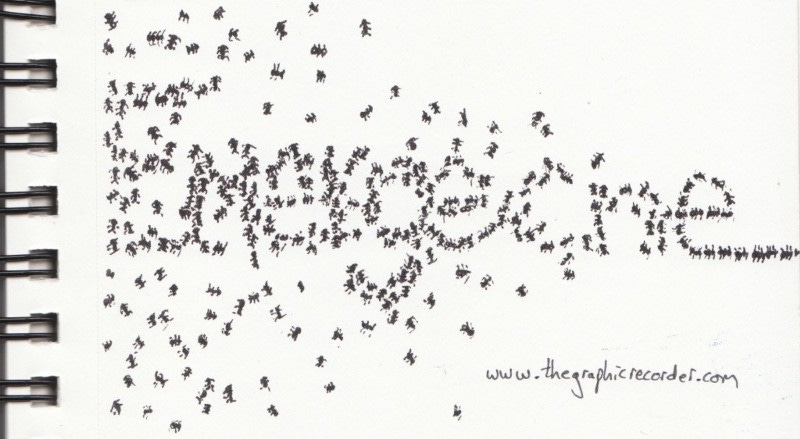

Emergence

The benefit of a network that approaches the scale-free ideal is that they’re far more likely to result in emergent properties: that is, groups of nodes that can generate exponentially greater creativity, innovation or problem-solving than the central node originally envisioned.

Some examples of networks that approach the scale-free ideal:

The internet

Open-source software development (including development in permissionless ecosystems such as Linux or Windows)

Smart-contract blockchains (financial legos may be interconnected between anonymized counterparties to create emergent, decentralized applications)

Wikipedia

Facebook (within the social network itself, not particularly in its development ecosystem)

My last two examples are cases where the network exists “in” the ecosystem as opposed to “on” the platform; this is an important distinction that I’ll return to in a bit. Before we do, let’s spend a bit more time on networks and how they grow and create exponential value.

Why Some Networks Approach Scale-Free

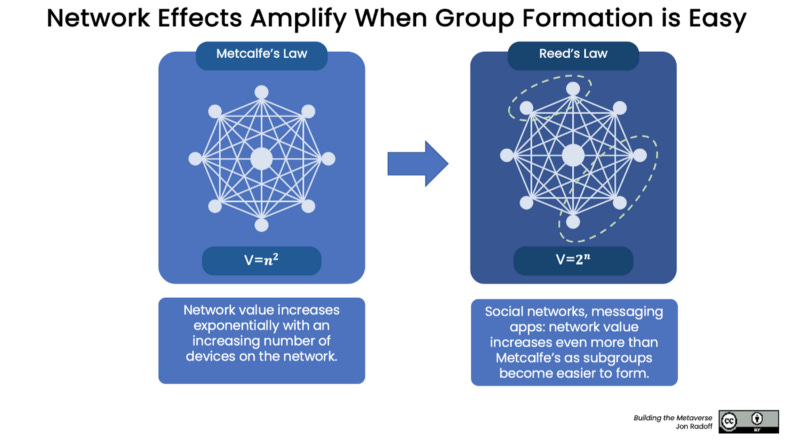

Metcalfe’s Law proposes that the value of a network increases geometrically with every device that’s added. It explains why the telephone network and the Internet are so valuable, and continue to increase in value.

Reed’s Law posits that Metcalfe’s Law actually underestimates the value of network, especially those in which it is easy to form subgroups.

Here are a few examples of Reed’s Law in action:

Social Media of all kinds (Facebook, TikTok, etc.) are so valuable because everyone is the center of their own subgroups, and everyone can easily add content.

Messaging applications like Discord allow you to easily form your own groups that serve as conversation hubs for games and projects.

Open Source software is incredibly powerful because projects can form and evolve rapidly, by opening up participation from anyone who wants to contribute — and builds upon contributions from completely unrelated projects.

Wikipedia became so important because content can be managed and evolved by the sphere of people who care most about certain topics. The collective value of wikipedia increases as people maintain more content, which in turn expands the audience, resulting in people wanting to add more content to it.

Online games with social features (multiplayer games, MMOs, games featuring esports) are so sticky because each one acts as a type of social network where you join up with other people, participate in activities, and form friendships and rivalries.

Like the ideal of a true scale-free network, I regard Reed’s Law as more of a conceptual framework for thinking about potential rather than mathematical certainty.

In the most constrained networks, subgroup formation is hard or impossible; value creation will disproportionately adhere to the central authority.

In a true scale-free network, subgroup formation is very easy. Enormous value is created across the network.

Radoff’s Law

Here’s the “Radoff’s Law”, which is really just my heuristic for thinking about the consequences of both Reed’s and the emergent properties of scale-free networks:

The degree to which a network facilitates interconnections determines the extent of its emergent creativity, innovation and wealth.

The Wealth of Networks

Back to Amazon, Microsoft and the metaverse.

Earlier, I hinted at the distinction between networks like Amazon (or Facebook) versus networks like the internet and more open ecosystems like Windows.

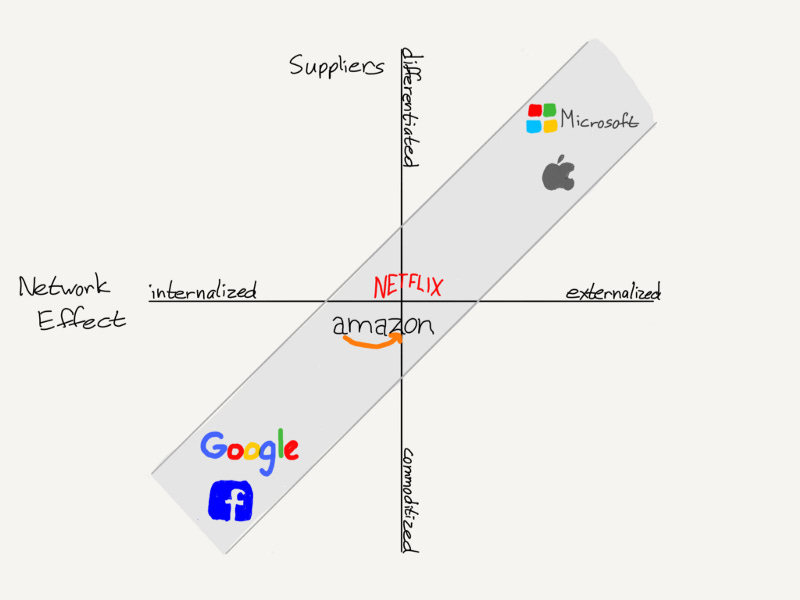

There are actually different types of network effects, which Ben Thompson lays out in his Moat Map (worth a complete read). In summary, there are both internalized and externalized networks:

Internalized and Externalized Networks

Internalized network effects are those in which the network exists inside an application.

The social network of Facebook is internal to Facebook, because all of your friends and family are using it; Google’s network is from its internal network of data and intelligence about search results that it has collected. Whereas Microsoft and Apple’s networks are actually more about the ecosystem of developers and creators they’ve enabled. Yet both are “network effects” because each webpage that’s added makes Google more valuable — just as each application made for Windows makes the Windows ecosystem more valuable.

Reed’s Law suggests that to maximize the value of an internalized network, it needs to be very easy to form connections between the units and subgroups within the internalized network: think of how easy it is to friend someone on Facebook, or join a group. For an externalized network, that means the the owner of the network needs to be very good at facilitating connections between the units on the network.

Internalized networks can create enormous value for the owner of the network:

On the other hand, externalized networks can create enormous wealth not only for the facilitator of the network but for the participants in the scale-free ecosystem as well. As Bill Gates is purported to say when asked whether Facebook is really a platform:

“That’s a crock of shit. This isn’t a platform. A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.”

Commoditized and Differentiated Suppliers

The “suppliers” of Facebook are the users (remember: if you aren’t paying for it, you are the product), and each supplier is perfectly commoditized (the way you can present yourself on Facebook is according to a very templated format, in contrast to the World Wide Web where you’d have infinite expression).

The suppliers of Google are web pages, but Google commoditizes them by presenting search results essentially the same for everything.

At the opposite extreme you have Microsoft and Apple, where applications in the ecosystem can be completely different.

This level of differentiation is a result of having networks that facilitate emergence, and that’s the wealth-maximizing function for the ecosystem.

I’ll say it again:

The degree to which a network facilitates interconnections determines the extent of its emergent creativity, innovation and wealth.

Differentiated Supplier Networks

Ecosystems that feature highly differentiated suppliers tend to benefit from building externalized network effects. That means more connective tissue, more embeddability, more mashups, etc.

To build networks in which the network is internalized, it is necessary to commoditize everything — because that’s what makes it feasible for one entity to enable the type of subgroup formation that Reed’s Law depends on.

When content is highly differentiated, it gets much harder for one entity to enable the formation of all these differentiated subgroups. The more efficient path is to offload their R&D to suppliers who have the maximum number of options available to them.

Let’s return to what that means for the metaverse.

Trajectory of the Metaverse

People sometimes called Roblox a type of metaverse. It is simultaneously a social network, a creative platform for making games, and a place to enjoy experiences both alone and with friends.

Content on the platform is fairly differentiated, due to the expressiveness of the tools… but not as differentiated and emergent as — for example — a game built on Unity, where you can draw upon the entire world of engineering and open-source, a huge industry of developers, and the freedom to build whatever you want in a permissionless ecosystem.

Room Enough for Two. Or Two Million.

Despite the somewhat negative connotation, walled gardens serve a very important purpose. They institute rules and expectations, maintain community standards, establish an aesthetic, appeal to specific demographics and simplify certain processes.

Walled gardens can be beautiful.

But walled gardens are part of the metaverse, not the metaverse.

Because the variety of experiences and activities in the metaverse are going to be so varied, it is unlikely that suppliers will be commoditized to the extent of the lower-left of the Moat Map.

Companies like Roblox sits in a similar place as Amazon in the Moat Map:

They control distribution to their population of users

They provide access to a relatively differentiated set of suppliers (the “builders”), who mostly deal with the platform (rather than each other)

They establish the rules that govern what suppliers are allowed to do

There are others following a similar path, but addressing different parts of the overall market: Rec Room, Facebook Horizons, Manticore to name a few.

Most creators are not going to want the constraints of any one walled garden.

In the same way that the Web, Windows and open-source development have maximized the variety of games and applications, this calls for a metaverse that is decentralized, permissionless, and built around open technologies.

That’s what will enable the most differentiated games and experiences — and the greatest degree of wealth creation.

Unity and Epic

We don’t yet know all the companies who deserve to be in the upper-right of a Metaverse Moat Map… but we already know that 3D engine technology, which is central to many of these experiences, has coalesced around two vendors: Unity and Epic’s Unreal Engine.

Unity is the most widely adopted 3D engine — and their business model (among other things) is to aggregate the demand for advertising across the inventory of all Unity games. Indeed, they’re so open that you can use Unity and a different ad network (IronSource, etc.) if you prefer.

It’s permissionless and open, not unlike Microsoft Windows or Adobe.

Epic’s Unreal engine is similarly open, at least from a technology standpoint. It has been an incredible force for creating game and other 3D content.

But Epic’s business model is evolving in a different direction: towards the walled-gardens of Fortnite and the Epic Game Store. This model is less about aggregating demand — and more about controlling distribution. Will it be possible for them to have their cake and eat it too?

Patterns from Ecommerce

One crystal ball we have for how the metaverse may evolve is to look at what’s happened in ecommerce.

If Roblox and the Epic Game Store (and Manticore, and Rec Room, and Facebook Horizon) are all examples of walled-gardens that follow in the (very successful) pattern of Amazon… And Unity fits the pattern of Microsoft in emphasizing an open ecosystem — how will the market in the upper-right continue to evolve?

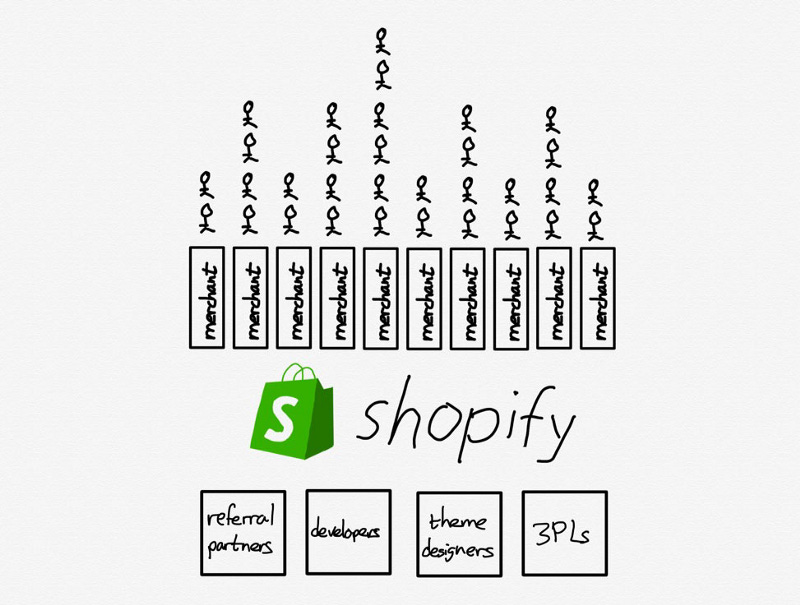

Shopify’s business model (as well as that of their main rival, BigCommerce) is to create an ecosystem of highly differentiated customers (the stores) along with a market of plug-ins and applications, referral partners, and certified consultants. They’re in the business of aggregating demand for ecommerce, rather than controlling distribution (as with Amazon).

With Shopify, each of their merchants acquires and deals with their customers directly, builds upon the Shopify platform, which then manages and connects merchants with an ecosystem of service providers and add-ons. Here’s how Ben Thompson describes it in a Stratechery post:

Back to the Metaverse

The metaverse contains a large number of components — everything from the 3D engines to the creator tools to the live services that enable immersive games and experiences.

Ecommerce offers a window into the business models that will play out in the metaverse.

Roblox and the Epic Game Store may play a role similar to Amazon: controlling distribution to large numbers of consumers. Metaverse creators will pay these platforms not only for providing tools, but for delivering the audiences.

Other companies will be similar to Shopify: creators will be more responsible for acquiring customers, but benefit from a wider ecosystem of interoperable services, components and vendors.

The metaverse will include games, social “third places,” augmented reality and other experiences limited only by our imagination. This means a market full of highly differentiated content, and an ecosystem of platforms that include both walled gardens and open architectures…

Which leads to the big question: will it be a winner-takes-all market in which one walled-garden captures most of the wealth?

If the history of the Internet and ecommerce is a guide, then we’ll get to have both — but it will be in an open and free metaverse where most opportunity is created.

Further Reading

In Experiences of the Metaverse I defined what the metaverse is, and what you can do in it.

In the Market Map of the Metaverse I categorized the main types of companies — from semiconductors and telecommunications networks on up to the experiences of the metaverse — who are building it.

Ben Thompson writes about how different companies create moats based on distribution and demand, with commoditized versus differentiated suppliers.

Learn about the concept of emergence from this very cool episode of Radio Lab.

Nick Szabo has a great article on social scalability, and why blockchains have taken off.

Scientific American published an article on scale-free networks to help you understand them better.