Compute Capital Markets

Beamable is creating the Internet Capital Market for infrastructure on Solana

tldr: cloud outages keep reminding us that compute isn’t the internet. Beamable Network is building the Compute Capital Market on Solana—a DePIN where capacity is tokenized, traded on‑chain, and streamed to apps in real time. Beamable’s foothold is the $200B gaming industry, but it’s not a gaming token: it’s infrastructure for the most demanding and spiky of developers—web2 as well as web3—that makes compute programmable, liquid, and resilient.

Why Decentralized Compute Matters Now

Earlier this week, AWS’s US‑East‑1 stumbled and a long list of apps blinked out—Alexa, Fortnite, Snapchat, Coinbase, and more—because a DNS‑resolution issue rippled through Amazon’s internal network. It was restored the same day, but it’s the same story we’ve seen before: a single failure domain can kneecap the modern web. Clouds are great—until they’re a single point of failure.

The takeaway: compute shouldn’t live behind centralized walls. It should behave like the internet itself.

Solana’s north star: Internet Capital Markets (ICM)

Solana’s ICM thesis is simple and powerful: put issuance, ownership, and trading of anything of value on a fast, low‑fee, globally accessible ledger—and let orderbooks be the primitive. This already underpins tokenized RWAs, equities pilots, and stablecoin rails (with headline metrics like $15B stablecoin supply and $1.2T annual DeFi volume on Solana). More importantly, the roadmap doubles down on market microstructure—things like Application‑Controlled Execution (ACE) and Multiple Concurrent Leaders (MCL)—so fully on‑chain markets clear in milliseconds. That’s the substrate compute needs.

From “cloud as a platform” to compute as a protocol

Think of tomorrow’s compute like this:

DNS for workloads: you target a class of service (latency, hardware, region)—not a vendor. Routing is automatic.

The power grid for capacity: there’s spot for right now, reserves for next week, and hedges for risk.

An exchange for price: a central limit orderbook (CLOB) clears bids and asks continuously, on‑chain. Solana already runs high‑throughput, fully on‑chain CLOBs (OpenBook, Phoenix), so compute price discovery and settlement can live right next to the apps that consume it.

In this model, suppliers post tokenized capacity; builders buy entitlements; payments stream per second; failover is a policy, not a phone call.

Beamable Network: leading with game infrastructure, building for the internet

Beamable Network isn’t another “gaming token.” It’s infrastructure: a DePIN that turns game servers, data, and live‑ops services into programmable, tradable rights on Solana—so studios can launch faster, scale economically, and stay online when any single provider wobbles.

Beamable already powers nearly a hundred live games in both web2 as well as web3, addressing the entire market for the largest media category ever created—video games.

Why start with games? Because games are the harshest, spikiest workloads on the internet. Beamable’s wedge is a vertical DePIN: not just devs (demand) and operators (supply), but players too, creating an attention‑driven flywheel that accelerates liquidity and adoption. That vertical dynamic aligns incentives across the stack.

What actually gets tokenized (and why it’s better)

The assets

Usage rights: fungible claims like N CPU‑hours in region X, latency ≤ Y.

Reservations: time‑boxed capacity windows (non‑fungible).

SLA receipts: performance‑attested outcomes for reputation and settlement.

Why a token at all (for buyers)

Programmability: rights are code—gate access, stream micropayments, auto‑refund on SLA misses. And you can plug compute spend into DeFi—bundle, finance, or hedge with one click on the same chain that runs your market.

Access & liquidity: acquire or exit positions instantly; capacity is portable across providers.

Cost & performance: a competitive market compresses spreads; Solana’s ~400 ms blocks and sub‑cent fees make real‑time clearing and granular billing feasible.

Composability: a scalable compute network frees software developers to build new solutions on top of an open ecosystem, so the entire community wins every time someone invents a new capability. It applies the benefit of crowdsourced and open-sourced software to the realm of network infrastructure.

Markets around compute: spot, reserves, perps, credit

Once capacity becomes an on‑chain right, finance shows up:

Spot markets for immediate workloads; reserve markets for launch windows.

Futures & perps on standardized capacity classes (e.g., “NA GPU‑hour index”) to tame price spikes.

Collateralized credit for suppliers, using reservations and historical SLAs as on‑chain reputation.

If you want proof that DePIN markets can sell real services at internet scale on Solana: Helium (wireless), Render (GPU rendering), and Nosana (AI inference) are already there. They validate the core loop of supply⇄demand clearing on a high‑throughput chain.

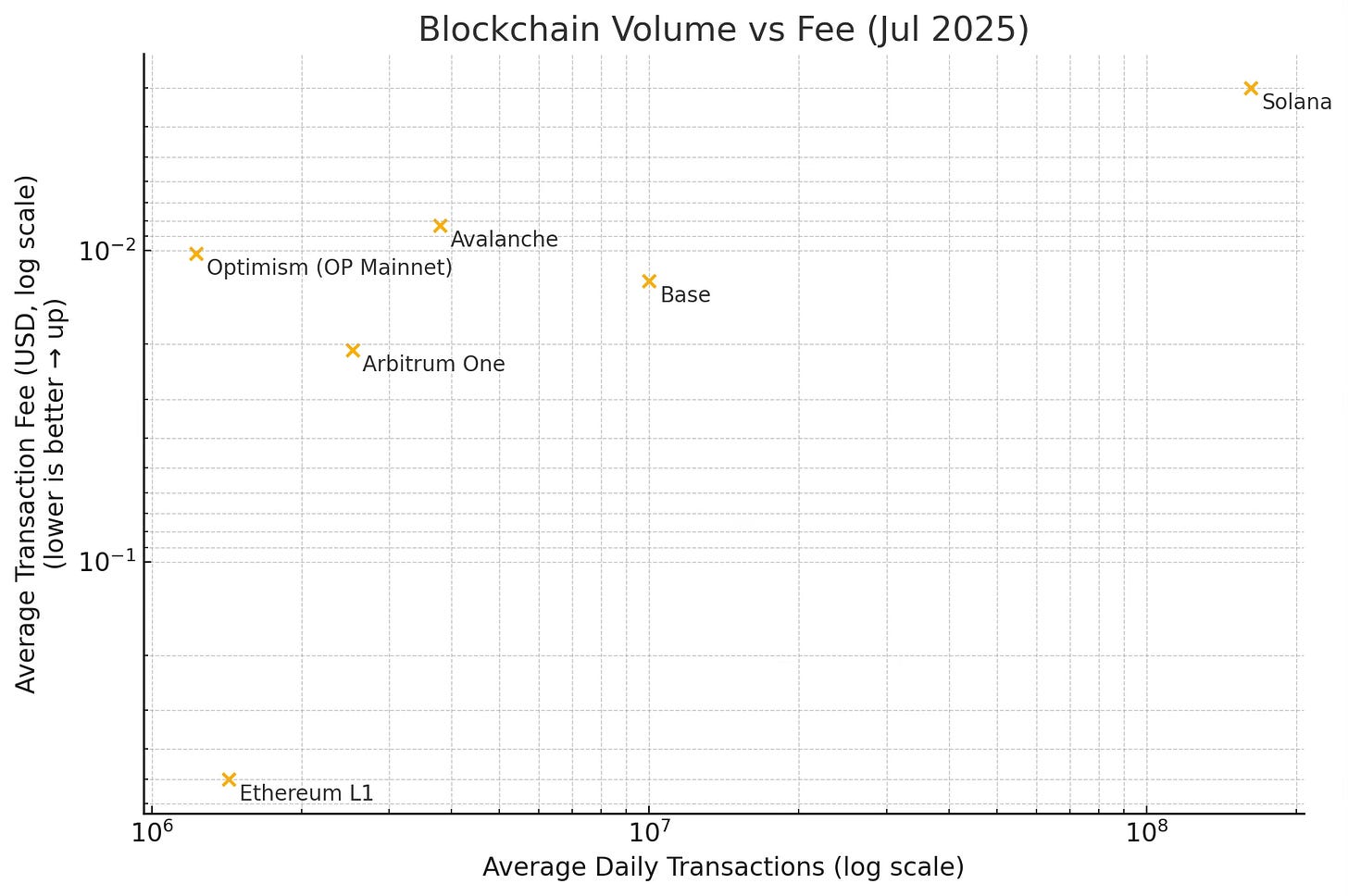

Why Solana is the right venue for a compute exchange

On‑chain orderbooks as a first‑class citizen: OpenBook and Phoenix prove you can run fast CLOBs directly on L1—exactly the microstructure compute needs.

A roadmap built for markets: ACE and MCL target the last mile—sequencing and inclusion for millisecond‑level market performance.

Enterprise‑grade tokens: Token Extensions bring compliance, transfer restrictions, and confidential transfers—useful for contracts and procurement.

Ecosystem gravity: ICM is already active across RWAs and stablecoins; compute slots right into the same liquidity and tooling. Similarly, most of the largest, revenue-generating DePIN projects are already on Solana.

Beyond the tech, Solana has also proven it can sustain the highest volumes of any low-cost network:

What this unlocks for builders today

Resilience by default: workloads fail over across a mesh of providers; you’re not hostage to one region or one platform. The AWS incident simply becomes a re‑routing event.

Better unit economics: competitive clearing pushes prices toward marginal cost. (Across DePINs, GPU/compute marketplaces routinely show savings vs. hyperscalers—a directional proof that markets, not lock‑in, set efficient prices.)

Frictionless access: studios can provision backend capacity in minutes, not procurement cycles. With Beamable’s SDKs, that’s one integration away from live ops.

Crowdsourced development: developers focus on their core application (in the case of Beamable, the fun of their game) and crowdsource various backend technology solutions to an open-source community of developers who are incentivized by the right to collect fees and creator royalties for their inventions.

What success looks like (near term)

Game studios buy capacity like they buy ads: in the spot market for live ops, with reserves for launches, and hedges for risk.

Operators finance hardware with pre‑sold reservations and reputation from on‑chain receipts.

Traders price the forward curve for compute and arbitrage across regions and hardware classes.

Players indirectly secure the network by creating real demand for infrastructure that anyone can supply.

Beamable Network is the wedge—game infrastructure first, the broader internet next. Studios get reliability and price; operators get utilization and financing; markets get a brand‑new, high‑velocity asset class. That’s not a “gaming token.” It’s internet infrastructure made liquid.

Conclusion

Cloud got us here. Markets will take us further. Solana supplies the rails; ICM supplies the playbook; Beamable supplies the first at‑scale marketplace where compute finally behaves like the internet—open, composable, and always-on.

Sources & further reading

AWS outage (Oct 20, 2025): The Verge timeline & cause

Multicoin “The Solana Thesis: Internet Capital Markets” (more oriented towards financial market dynamics) and Anza’s Internet Capital Markets Roadmap (more technical details of supporting technologies such as Asynchronous Program Execution, Jito, DoubleZero, etc.)

ICM thesis + market microstructure: Multicoin’s “Solana Thesis: ICM”; Anza’s ICM roadmap (ACE/MCL); Helius’ ICM explainer. Multicoin Capital+2Anza+2