Wright’s Law: Cloud, Blockchain, and the Rise of DePIN

From AWS price free-falls to sub-penny on-chain fees, see how cost curves converge into decentralized physical infrastructure (DePIN).

There’s a growth engine that powers nearly every technology industry: it’s called Wright’s Law. Each notch down in price pulls in new customers. Their activity drives innovators to learn new ways to optimize and save money, spinning an unstoppable flywheel of adoption.1

You’ve already seen this play out already: cloud computing turned racks of hardware into on-demand infrastructure for software, and blockchains slashed transaction fees until entire economies could live on-chain.

Now those two forces are colliding to create decentralized physical infrastructure networks (DePIN)—where unused bandwidth, compute, and energy are stitched together by code into a planet-scale super-cloud.

Let’s trace the curve, follow the money, and glimpse the next S-curve of the Internet.

This article was updated on July 15 to include additional data about Avalanche transactions and volume.

Exponential Blockchain Growth: Costs down, Volume up

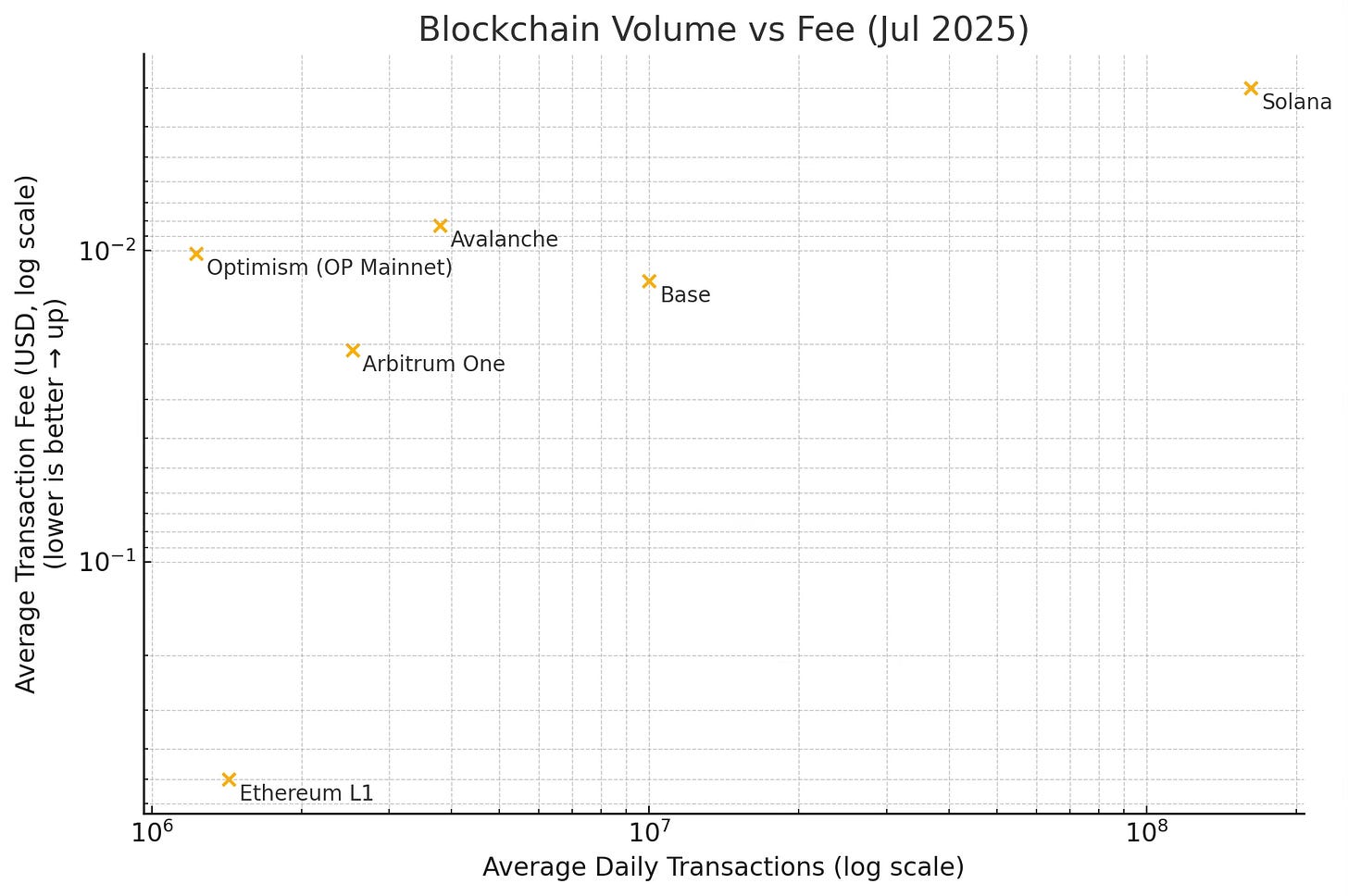

I charted total transaction volume on Solana, Optimism, Base, Arbitrum, Avalanche and the original Ethereum to see how transaction fees and volume relate to each other. As one might expect from the Wright’s Law cost curve, the highest volumes correspond to the lowest costs amongst these blockchains. Solana is far-and-away the most volume of any of the large blockchain projects, and it’s no surprise that it got there by learning to create one of the most efficient and lowest-cost chains:

Ethereum’s growth has been sustained by an orders-of-magnitude drop in transaction-costs.

The decreases in unit-costs that accompany higher volume are a function of the “learning rate.” This is the mathematical expression of how an industry learns to reduce costs, passing along cost reductions to customers through competitive market forces.

Alongside Ethereum’s growth and improvements is the emergence of Layer 2 networks, which help Ethereum scale through interoperating, separate chain architectures. These layer 2’s have had their own learning journey: Arbitrum volume has increased 8x while its average transaction over a period that transaction costs decreased by $0.20 to $0.03 (-38% learning rate) thanks to things like their sequencer upgrade (Nitro).2 Base has had its volume increase 7x while its costs decreased from $0.04 to $0.012 per transaction (-27% learning rate).

Solana supercharges on-chain volume

There’s no large-scale blockchain that exemplifies Wright’s Law more strongly than Solana. By freeing itself to the technological constraints of Ethereum entirely, it created a high-performance, low-cost network where its average transaction fee is 1% of the average of Layer 1’s:3

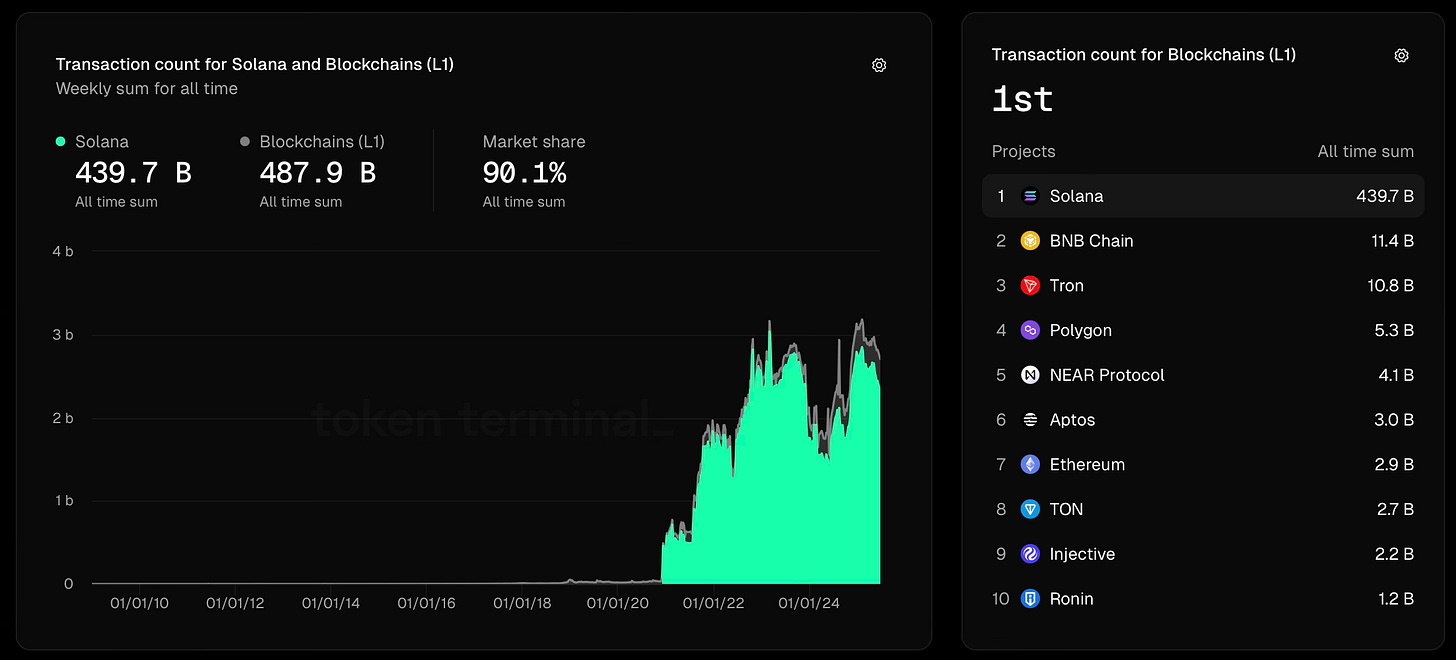

Solana’s early market lead, low cost and high-TPS has led to it now processing far more transactions than all the other Layer 1’s combined:4

This ecosystem is why many of the top DePIN projects (Beamable, Helium, Render) have chosen to build on Solana. As Solana DePIN projects grow, they’ll in turn drive even greater volume onto Solana—which will result in further learnings to reduce costs.

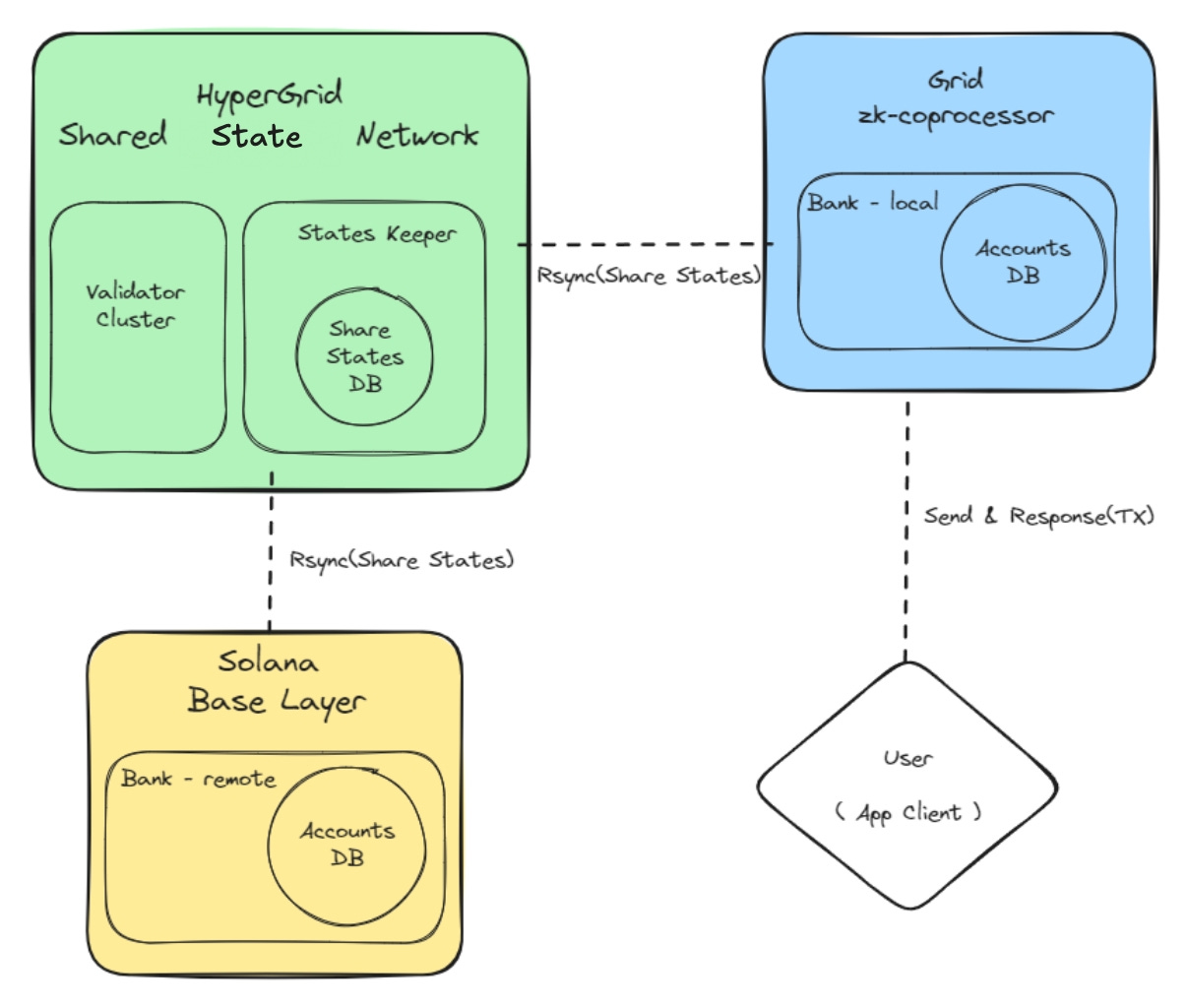

One example of this learning is Sonic, which is building the first layer 2 for Solana. It’s called Hypergrid, which is for “high-demand applications like games, DeFi, AI Agents” [Sonic docs]. By building a layer 2, these demanding applications can further reduce their already-low Solana transaction costs:

Markets for Internet Servers

Cost curves extend well-beyond blockchain; another great example is the cost of running internet servers. The pioneer in this industry is Amazon, who invented Amazon Web Services to allow other companies to rent Amazon’s massive datacenters to power their own applications. Along with Microsoft Azure, Google Cloud Platform and others, this market today operates from over 1,000 “hyperscale” data centers:

Why did this happen? It turned large hardware investments by individual companies into data centers (CapEx) into pay-as-you (OpEx). The learnings within this industry have been enormous, resulting in order-of-magnitude decreases in unit-costs of compute while driving exponential increases in utilization:

One of the key learnings in cloud is called “serverless” compute. One example of serverless is AWS Lambda, which works like this: you stop renting a whole server by the hour, and instead pay only for the few milliseconds your code is actually running. Behind the scenes AWS keeps a giant pool of machines and loads your function onto one just long enough to finish the task, then frees that space for someone else. Functions that sit idle 99 % of the time on a virtual machine cost 90% less once billed in 100 ms increments. These are the sort of efficiencies that have continued to make cloud computing such a compelling option for customers.

DePIN: The Successor to Cloud

We are on the threshold of the next generation of cloud architecture, called decentralized physical infrastructure networks. DePIN is like Uber, but for computers and other hardware—instead of renting capacity from a central provider like Amazon, you “ride share” on the resources provided by owners on the network.

The mechanics of DePIN will fuel the next generation of cost decreases and expanded utilization:

Competitive market forces converge costs closer to underlying energy and CapEx usage—effectively turning compute into a new liquid asset class. Hardware & bandwidth costs decline because more nodes across multiple suppliers = market-based pricing, denser resource mesh, better routing, higher utilisation—classic learning-curve mechanics.

DePIN infrastructure builds upon serverless compute by allowing multi-tenanted nodes to maximize their use of underutilized compute resources.

Similar to Uber, the network gets more valuable the denser the network is around you—some people will offer a “black car” premium level of service (high-end compute resources), vs. others will drive you in their UberX for lower cost (cheap servers). Applications can optimize their costs around a market of suppliers with varying service levels.

DePIN accelerates the software development flywheel. As network effects attract third-party builders who compose solutions on top of the DePIN, they attract more customers who like the wide availability of open-source solutions, who attract more third-party builders…

Nearly a hundred years of Wright’s Law has shown that further increases in utilization will happen alongside cost decreases, leading to overall market expansion. As node counts double, expect another ~20-30 % slash in compute / 5G / storage prices—opening markets like more innovative games and simulations, real-time AI inference and edge rendering.

At Beamable, we’ve seen this firsthand in the game industry: innovations in serverless compute have enabled us to efficiently support the backend needs for everything from massive game launches, such as Mythical Games FIFA Rivals—to scrappy startups like RC Games Studio, who were able to ship an online game with 94% positive ratings on Steam with a tiny team.

Beamable Network is the gaming DePIN that builds upon the efficiency of serverless, open ecosystems and the power of Solana. We’re excited to supercharge game development—while opening up a whole new universe of community-owned gaming infrastructure.

In 1936, Theodore Wright plotted the labor hours to build the Curtiss-Wright P-36 Hawk. A single airframe took ~15,000 hours at unit #1 but only ~8,500 hours by unit #100—about a 21% drop per doubling of cumulative production (i.e., the “learning experience curve”).

EIP-4844 “proto-danksharding” cuts calldata fees by ~90 %. For Arbitrum, that turned a January 2024 average of $0.23 per user-op into $0.03 by March—an implied learning rate of -38% per doubling of cumulative batches in just eight weeks.

Even during a memcoin peak memecoin on April 6, 2024, non-vote fees averaged $0.012. Solana’s fee market hard-caps priority fees, so you literally couldn’t pay $5 even if you wanted to—an architectural commitment to Wright’s Law.

Someone will point out that a lot of transaction volume on Solana is non-financial and hence doesn’t reflect direct user activity. Even if you apply the 75% reduction in transactions that some use, that still places Solana at 10x the second-highest chain (BNB) by volume. But blockchains are increasingly going to absorb non-financial on-chain data, and I see that as a feature, not a bug, in how we analyze the performance of a chain, and reflects expanding utility under Wright’s Law.