Enshittification and The Future of AI Agents

Why autonomous tools—not new walled gardens—may rescue our time online

The internet today is organized into annoying silos. One of the most obvious examples is instant messaging. I use Slack, Discord, Telegram, WhatsApp, Facebook Messenger, LinkedIn and X on a regular basis—and I know that many of you are in the same boat.

Contrast this with email, which isn’t as fun, immediate or conversational: but does have the advantage of being a universal standard. There’s no CEO of email and there’s no central tax on email. Anyone is allowed to create and monetize (or offer for free) software or services that provide interfaces into email.

Instant-messaging platforms rarely interoperate,1 and that’s by design. The profit motive to capture and control user identities—which is largely accomplished by isolating these communication channels—is so strong. It’s the essence of enshittification: capture market share with a better user experience, habitualize usage patterns, and then simultaneously increase switching costs while you extract more and more value.2

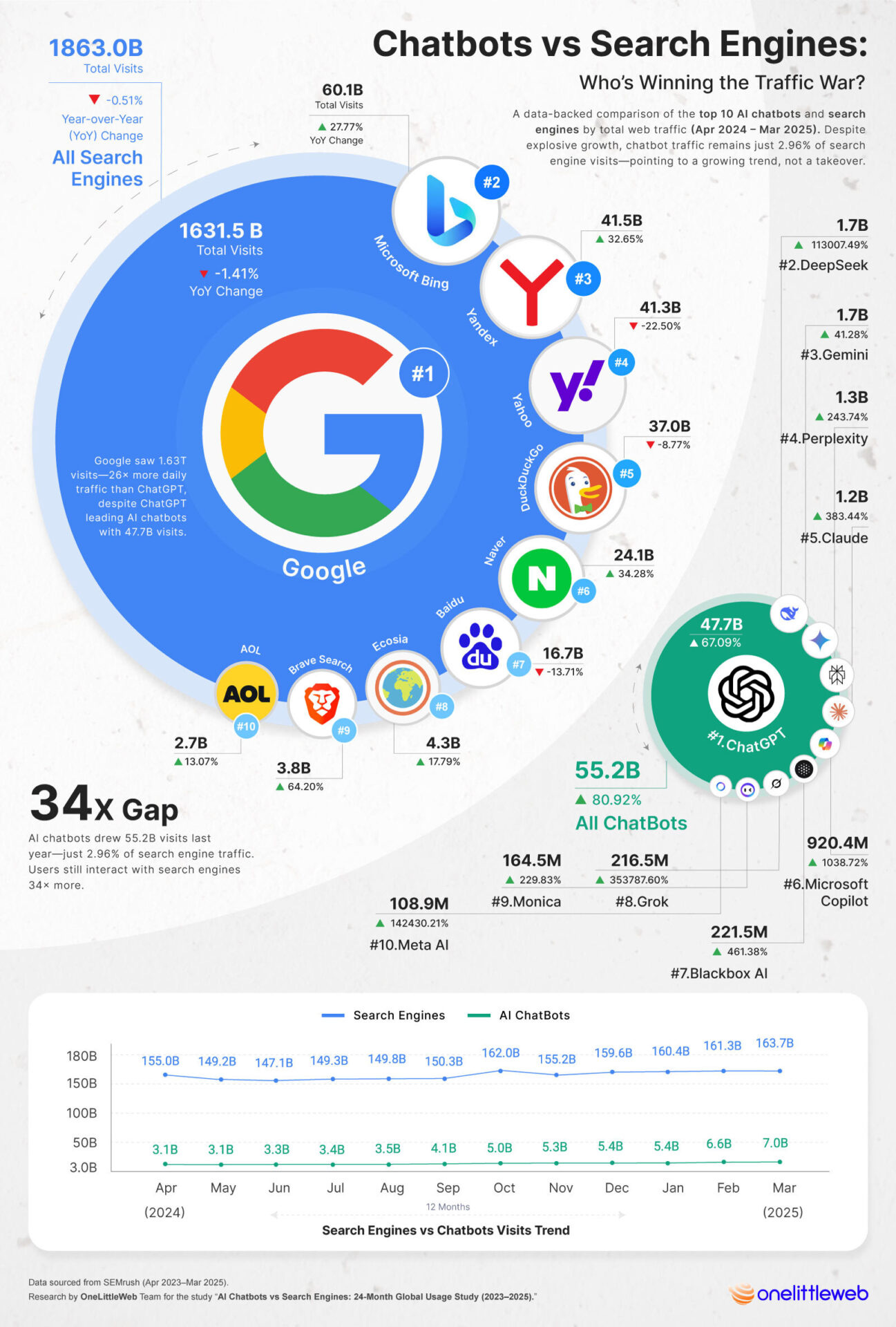

Another example we’re all familiar with is search engines, which have become increasingly clogged by advertising and SEO-driven chaff. But in a short period of time, chatbots—while still suffering from hallucination issues, albeit far fewer than when chatgpt first launched—have taken off:

The above chart understates the effect, leading one to believe that only a half-percent dip in Google usage isn’t much. But compare this against the calendar-year 2023-2024 growth rate of Google Search, which was more than 20%. Chatbots have put a huge dent in search growth.

But even this statistic understates the difference: the way one ought to measure chatgpt isn’t the number of “interactions,” but the value of our time spent. The fact that people need to do a lot of searches on Google3 could be more about enshittification than utilization. Ask your friends, and they’ll probably tell you how they are shifting towards questioning chatgpt first, and only verifying with search after.4

Amongst our younger generations, the trend bodes even worse for search engines: “Google feels like a backup, not a first stop,” observes one author commenting on how GenZ is moving away from search engines.

Which brings us back to what the solution might be: ChatGPT is a better wrapper for internet content than search engines, because its lower level of enshittification results in a higher time-value. Similarly, many other applications will be improved by an AI-enabled intermediate layer, one that gets us the results we want, navigating around the many commercially-influenced and enshittified applications that exist on the internet today. Perhaps the solution to the instant-messenger siloes I observed above will be an AI agent that floats over all your IM applications—orchestrating, surfacing and relaying messages through an agentic super-app that controls all your other programs through direct UI control.

More and more of our moment-to-moment interactions will be automated through the use of AI. This raises the question: how long until enshittification takes its inevitable toll on chatbots as well?

So far, AI applications are so compute-intensive that they’ve depended on a business model that favors subscription over advertising (meaning you—rather than the advertiser—are the customer). But another is that chatbots are actually relatively easily replaced: if you find one that does a better job, there’s hardly any switching cost.

We’re also moving towards a model where centralized AI silos might not completely dominate this market—already, more and more LLMs are moving onto your personal devices. In a lecture at MIT in 2023, I discussed how important these device-based LLMs will be: AI will increasingly be about not only generating, but projecting our will into the internet. To ensure that they have our own interests in mind, we’ll want to preserve our freedom to select and parameterize them however we choose.

The hardware to support this is already happening: smartphones with built-in generative AI capabilities are surging:

…yet that is itself a mixed blessing. While being able to run AI on our own phones is a good thing, the operating system on phones is largely under the central control of Apple and Google. Having an AI agent that can control our interfaces the way we want is something we’ll need to depend on Apple and Google for—and UI automation isn’t exactly the thing they’ve been helpful with so far. This may remain the domain of our mostly free-and-open PCs for now (or perhaps this will become another opportunity for cloud-streaming applications that let us run remote desktops inside our phones).

But AI agents do more than provide a better interface atop our enshittified applications: ultimately, they will carry our will: optimizing our health, wealth and well-being.

Once agents can act, they also need to pay.

Many of the applications, resources and tools we prefer will shift back towards a direct payment rather than a depending on ads. And many of these payments for services will be in the form of micropayments—pennies or less—to perform a service, interacting with an internet-scale swarm of intelligent experts.

One might imagine Apple would be uniquely positioned to thrive in this world, given the existence of Apple Pay and Apple Cash; yet Apple Cash is currently limited to US-only users, and Apple Pay operates on the Visa debit card rails.

These rails are not well-suited to micropayments: Apple Cash (a Visa Debit virtual card) enforces a $1 floor on peer-to-peer transfers.5 Generally speaking, Visa network fees include a $0.05-$0.15 transaction charge plus 2-3%. At microtransaction scale, the percentage is a rounding error but the transaction fees and minimums effectively eliminate micropay-as-you-go. Contrast this with a high-performance blockchain like Solana, where transaction fees in June 2025 are around $0.005 and where on-chain stablecoins like USDC are divisible down to $0.000001. This, among many factors, is why stablecoins surpassed Visa in total volume in 2024.6

The market of unbundled software is uniquely suited to blockchain, with its ability to transact tiny payments with minuscule overhead, enabling pay-as-you go at mass scale. Furthermore, blockchain provides a transparent mechanism for recording the authenticity and safety of these many applications.

This is a fundamental shift towards how software is being developed—and will continue to be developed—in the future. It is a trajectory away from bundling and SaaS, towards decentralized protocols that embed payment alongside functionality.

That combo doesn’t just tame enshittification—it hands developers a toolbox for shipping pay-as-you-go features in a weekend. In the next piece I’ll unpack how these modules work, and why the dev experience is about to get shockingly simple.

Remember when we all ran ICQ #s and could chat with AIM or MSN friends through a single app like Trillian?*¹ That brief era of quasi-interoperability died for the same reason email survived: incentives. Once the big portals (AOL, Microsoft, Yahoo) wanted to sell ads, lock in identity, and upsell “exclusive” features—file-sharing, voice, later mobile push—each one deliberately broke compatibility or threatened legal action against multiprotocol clients.

Cory Doctorow first coined “enshittification” in Social Quitting.

People are trained on the fact that paid clicks are annoying and organic results are interesting: paid placements now capture ≤ 6 % of clicks, while organic listings get 19× more attention—evidence that users are skimming past the paywall. YouTube doubled the number of ads in May 2025 unless creators opt-out. That said, it’s often hard to find the real results if you’re searching on Amazon these days: Amazon Ads, which interfere with you finding the actual product you want, was double the size of the global advertising market in 2024 ($56.2B).

According to a Pew Research study, only 2% of adults trust chatbots “quite a bit.”

The $1 minimum is Apple policy (not a Visa rule). Apple Cash operates through program-bank Green Dot, which pays a fixed ≈ $0.04 interchange on each Visa Debit transaction; combined with charge-back overhead, that makes sub-dollar transfers uneconomical.

“The annual stablecoin transfer volume reached $27.6 trillion last year, surpassing the combined volumes of Visa and Mastercard by 7.7%” according to the linked article.